How Would You Like Your Money to Grow?

At Shabazz Consulting, we understand that growing your wealth is essential to achieving your financial goals and securing your future. There are various options available for growing your money, each with its unique benefits and risks. Here, we’ll explore three primary growth options: Fixed, Variable, and Indexed.

Fixed Growth

Fixed growth options offer stability and predictability, making them an attractive choice for investors seeking steady returns and capital preservation. With fixed growth investments, you can expect a guaranteed rate of return over a specified period. These options are well-suited for conservative investors or those nearing retirement who prioritize income certainty and want to safeguard their capital against market volatility. Examples of fixed growth investments include fixed annuities, certificates of deposit (CDs), and government bonds.

Variable Growth

Variable growth investments offer the potential for higher returns, but they also come with increased market risk. Unlike fixed growth options, the performance of variable investments is tied to the fluctuations of the market. While this means greater potential for growth, it also entails the possibility of experiencing losses during market downturns. Variable growth options require active management and are best suited for investors with a longer time horizon and a higher risk tolerance. Examples of variable growth investments include mutual funds, stocks, and variable annuities.

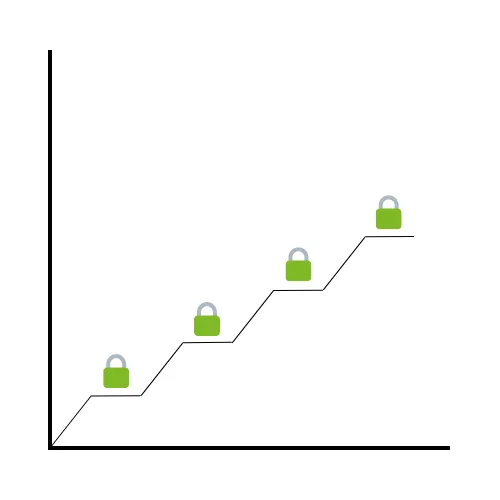

Indexed Growth

Indexed growth investments offer a balanced approach, combining elements of both fixed and variable options. These investments are linked to the performance of a specific market index, such as the S&P 500, but also include features to limit downside risk. Indexed growth options provide the potential for higher returns based on market performance while offering protection against significant losses through features like guaranteed minimum returns. This makes them an attractive choice for investors seeking growth potential with some level of security. Examples of indexed growth investments include indexed annuities and indexed universal life insurance policies.

Choosing the Right Option

Selecting the right growth option depends on your financial goals, risk tolerance, and investment horizon. At Shabazz Consulting, our experienced advisors can help you evaluate these options and create a personalized investment strategy that aligns with your objectives. Whether you prefer the stability of fixed growth, the potential for higher returns with variable growth, or the balanced approach of indexed growth, we’re here to guide you every step of the way.